by KLI | Aug 13, 2015 | Android, iPhone, mobile, usability, UX, Wearables

by Eugenio Santiago

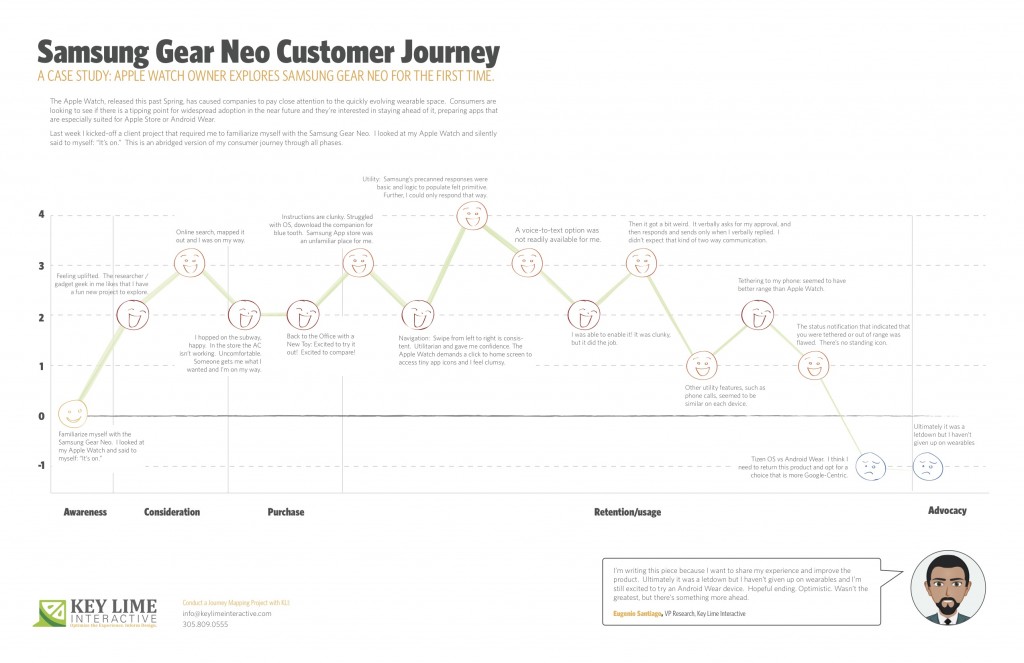

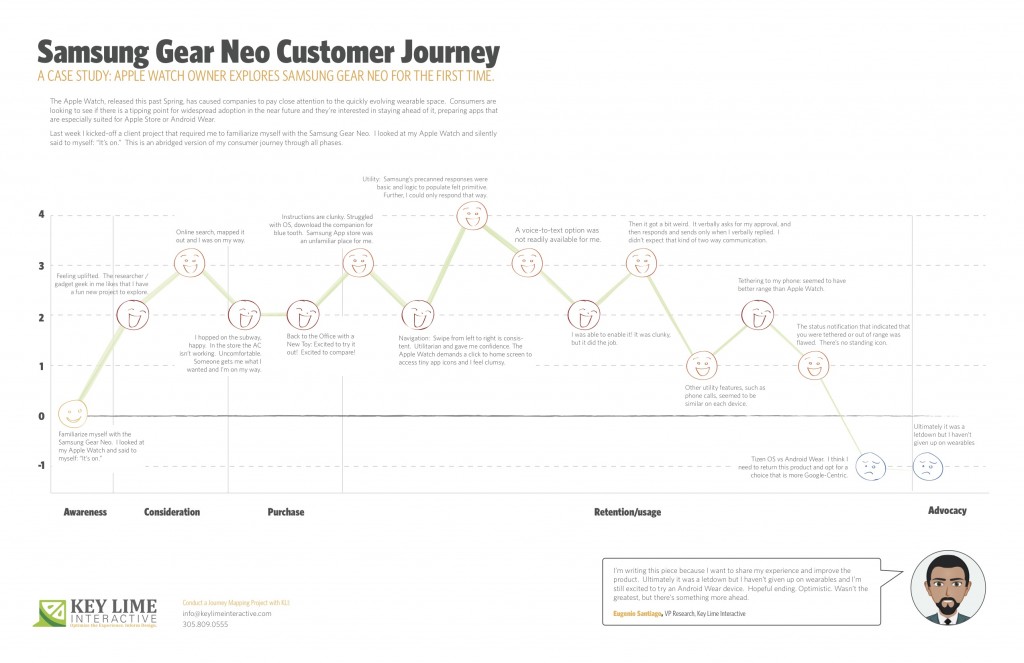

The Apple Watch, released this past Spring, has caused companies to pay close attention to the quickly evolving wearable space. Consumers are looking to see if there is a tipping point for widespread adoption in the near future and they’re interested in staying ahead of it; preparing apps that are especially suited for Apple Store or Android Wear.

About a month ago I unpacked a lime green Apple Watch, paired it with my iPhone and wore it around town. In true researcher form, I found myself paying close attention to every new feature and announcing to my colleagues which features impressed me, and which failed me.

Last week I kicked-off a client project that required me to familiarize myself with the Samsung Gear Neo. I looked at my Apple Watch and silently said to myself: “It’s on.”

I should mention, I’m not an original member of the Apple Fanclub. I stuck to my Samsung Android mobile device for many years as the Apple products evolved. Eventually, I moved to Apple, mostly so that I could keep up on the current offering as much of my project work at KLI demands this. I looked at the Samsung Gear Neo with a wide open mind. I was excited to learn more.

The abridged version of my consumer journey is detailed here, including these typical phases of a consumer journey:

– Awareness

– Consideration

– Purchase

– Retention/Usage

– Advocacy

Awareness:

Last week I kicked-off a client project that required me to familiarize myself with the Samsung Gear Neo. I looked at my Apple Watch and silently said to myself: “It’s on.”

Consideration: Product Research & Purchase

+ 2 Feeling uplifted. The researcher / gadget geek in me likes that I have a fun new project to explore.

+ 1 I took a look on online, CNET.com, the Samsung website, confirmed that particular apps were available and I mapped out the nearest location where these are sold and I was on my way.

Purchase:

– 1 Travel to the store, beautiful outside but quite hot, I hopped on the subway, happy. I walked into the store and the AC wasn’t working, It was stuffy and uncomfortable, overall it sucked. Someone helped me out, got me what I wanted and I was done and on my way.

Back to the Office with a New Toy

+2 Excited to try it out! Excited to compare!

Retention/Usage:

– 1 I open it up and the instructions are clunky. I struggled with the Tizen OS, the pairing options were not straight forward. After re-reading the instructions I recognized that I needed a specific URL to download a companion for blue tooth communication. When I arrived at the Samsung App store, an unfamiliar place for me, I felt I had to fend for myself. No one was waiting to welcome me and show me around, per se.

+ 2 Navigation: Typically, on the mobile experience, you swipe from left to right to move ahead in a variety of different scenarios. On the Samsung Gear, this is consistent. It was intuitive and clear. Utilitarian and gave me confidence in navigating through. The Apple Watch, by comparison, demands that you click to return to the home screen and access app icons in a rhombus shaped cloud, they’re tiny, and I feel clumsy. I liked what I was seeing on the Neo.

Usage:

– 1 Utility: I first took a look at messaging as our first example. Apple executes this well. They have pre-canned text responses that seem to make sense and fit my standard vernacular. They were smart responses to the incoming message. Samsung had this too, but in my anecdotal experience the responses were basic and the associated logic to populate them felt more primitive. Further, I could only respond via precanned text.

– 1 A voice-to-text option was not readily available for me. I eventually found it, after going to my phone to set this up, check through T&C’s, and activating it for use on my watch.

+ 1 I was thankful for that. It was clunky, but it did the job.

-2 Then it got a bit weird. On my Apple Watch I was able to speak my text, review it, and push a button to send the message. On the Samsung I realized that once I was in a scenario where I was using voice-to-text, this was my only option. I’d speak my message, then the system would recognize that I would finish speaking my message and it would cycle through to a screen where I would be prompted to approve of the message. It verbally asks for my approval, and then responds and sends only when I verbally replied. I found it to be a bit uncomfortable that the watch was talking to me during instances when I didn’t expect that kind of two-way communication.

0 Other utility features, such as the acceptance of an incoming phone call, for example, seemed to be similar on each device.

+1 Wearing it for a longer period: Tethering to my phone: I will say that without running a full technical analysis, it seemed to me that the Samsung watch seemed to have better range, so that was a positive.

-1: However, the status notification that indicated that you were tethered or out of range was flawed. Samsung notified me that I was no longer connected, but after that point in time identified no icon or indicator that I was disconnected. If I missed the notification prompt I may not have known that I needed to reconnect or get closer until I actively attempted an activity. Apple has a standing icon.

-2: The Samsung Gear was released in spring 2014. Shortly after the Android Wear release was made for select hardware devices, not including the Neo, it continued to run on the Tizen OS. I think I need to return this product and opt for a choice that is more Google-Centric. I’d liked to have explored a more seamless experience, the “cue card”, full integration with my mail, and more.

Advocacy:

I’m writing this piece because I want to share my experience and improve the product. Ultimately it was a letdown, but I haven’t given up on wearables and I’m still excited to try an Android Wear device. Hopeful ending. Optimistic. Wasn’t the greatest, but there’s something more ahead.

by KLI | Jun 11, 2015 | Archived Press Releases, Competitive Index, usability, UX

by Jennifer Knodler

It’s been a few years now, but I recall distinctly when the transition to mobile in the travel industry happened. I was in the midst of traveling often for business and I said to Sidra Michon, Product Usability Manager at KAYAK, that I felt like I needed to sort hotels by “Free access to print your boarding pass”. She chuckled at how real my problem was. A few months later, Brian Sullivan, then at Sabre, suggested to me that I wouldn’t need anything but my phone (my shiny new iPhone, that was) in the coming months.

Then, it was a domino effect. I could book my flight, complete a purchase for my luggage, use my phone as a boarding pass, book a hotel, check in, aggregate my travel itinerary, order takeout to my hotel room, hail a cab, use Wi-Fi on the flight and in the airport, map my route, even if walking in NYC. I could dictate emails while in transit, listen to webinars via conferencing software, check the CRM system for updates, get notified about travel changes and delays. The single most powerful tool that I had available was my smartphone. I didn’t need a wallet, a computer or a pen.

Today’s travelers are exactly as Moxie describes: “Tethered, Tolerant and Talking vs. Mobile, Multitasking and Messaging”. They need to be reached in different ways. Dana Bishop, primary report analyst and Director of Quantitative Research, was awed by the mad scramble of traditional travel companies to throw their hat in the “last minute arena”, as she puts it. It seemed that this Mobile, Multitasking and Messaging culture wants instant, satisfying and simple, too.

As a result, the Competitive Report Division of KLI, run by Bishop, recently announced a new report in our Competitive Index portfolio that focuses on overall functionality and experiences offered by today’s last minute hotel booking apps. Titled Last-Minute Hotel Booking Mobile Competitive Index Report, KLI reviews sixteen (16) apps including those designed specifically for booking last-minute travel as well as the top OTAs in the U.S.

This is more than an industry standard travel technology survey. KLI asks users traditional questions about their current behavior to understand trends, but they push to learn about the innovation that consumers are buzzing about, what they expect to see next, what barriers to a perfect experience exist.

“With many players in direct competition to secure a place to rest your head while traveling, the indecision about which booking agent or OTA to use can be paralyzing to the user.” says Phillip McGuinness, report contributor. “As with all of our reports, we survey the target audience to see what they need and want in terms of features and capabilities first. Then, we take those desires into consideration when comparing and ranking the apps, giving more weight to consumer’s top priorities.”

Apps in this assessment include: Airbnb, BookingNow, Expedia, Hipmunk, HotelPlanner.com, Hotels.com, HotelTonight, Hotwire, Jetsetter, Last Minute Travel Deals, Orbitz, Priceline, Room 77, Stayful, Travelocity and TripAdvisor.

The review examines their iPhone and Android apps (where applicable) and ultimately ranks the apps, awarding top rank to those who most effectively meet the consumer’s self-defined need.

Buyers receive a detailed report that identifies the survey results and the associated ranking of the 16 apps. They also benefit from detailed best-in-class features including screen prints and expert analysis. Opportunities for improvement are discussed as well as a new trends and innovation section where new concepts such as the use of an app to open hotel room doors or a mobile chat feature to communicate with hotel staff are highlighted.

“Differentiation such as the ability to set style preferences, access customer reviews, set filters, as well as view saved search history and favorites become apparent. Better, the impact that these features have on the user experience or the ability to meet user preferences is identified.” states Bishop. “Organizations crave both a way keep pace with what consumers want as they build their roadmap while also tracking and scoring themselves against the competition; to have a baseline that they want to beat as they continue to evolve. This offers them just that.”

Read the full press release here.

To purchase the published report, please reach out to Key Lime Interactive for more information here.

by KLI | Nov 12, 2014 | Conferences, Cultural Impact, Humor, iPhone, mobile, usability, UX

by Kelly Nercess

Lets face it. We live in a society where the majority of people are glued to their mobile devices. Whether it’s texting a friend, finding an online recipe for dinner, or taking a selfie…everyone, at one point or another, is guilty of being attached to their smartphone.

During the Big Design conference in Dallas this year, I had a chance to attend Pamela Pavliscak’s workshop on “ The Real Mobile Experience”. Aside from her entertaining jokes and quick wit, she gave us a her insights on what people really do on mobile phones and how to design for those activities.

Some quick facts:

– For every baby born, there are five mobile devices activated

– 7 billion mobile phones in the world. 55% of those are smartphones

– Typical mobile users check their phones 150 times a day

– Smartphone owners spend over 2 hours on their phone each day

– 21% of US mobile phone owners go online primarily using their phones and globally that number is even higher

– Out of preference: 50% of smartphone owners under 30 use the Internet primarily on their mobile phone

– Out of necessity: 55% of Americans who make less than $30k/year have no web access at home

– For convenience: 34% use the device simply because it is close at hand

– 29% say that their phone is the first and last thing that they look at everyday

– 44% sleep with their phones (in a very platonic manner)

Based on the data that Pavliscak reported, people show a remarkable dependency on their smartphones. The fact that we now wake up and go sleep with this electronic device by our side can even be intimidating for a spouse. Women were asked if they would rather give up sex or their mobile phone for 1 month. Can you guess the answer? 48% of women said they would rather give up sex, while the other 52% said they would rather do without their mobile phones. Hmm, interesting. Where do you fall on the spectrum?

An experiment was performed where she asked 250 people to “take a look at their phone”. She was requesting the owner to just happily pass their phone over to a perfect stranger. The result:

– A slim amount of people actually handed over their phone

– Some made an excuse not to pass it over

– Some also just instantly put their phone away

– Majority of people would hold the phone out and show it while it was still in their possession

So, what does this mean for society? We are way too overprotective of our phones. It’s as if it was our newborn child.

In addition to our phones providing a channel for enhanced social interactions, they also allow us to also solve problems. Pavliscak reported that 86% of people solve problems with their phones, which includes troubleshooting emergencies. What else do we use our devices for? High on the list is making sure our kids are happy. Only 20% of parents don’t use tablets or phones to keep their children occupied. So next time you are at a restaurant and you see a young child playing Angry Birds as opposed to eating their macaroni and cheese, you can look at them and think “Oh, you’re part of that 80%”.

We all know that we love and adore our phones, but what are we really doing on them? Ms. Pavliska proposed another experiment to research what we are spending our time on when our eyes are glued to that mobile screen. Even though we look at it over 150 times a day, we’re usually using it in three ways:

– 72% of the time we Tap

– 77% of the time we Swipe

– 94% of the time we are Scrolling

People know how to use the zoom button, but surprisingly a lot of us will continue to read the small text as opposed to using the gesture to make it larger. How can we optimize the mobile experience based on this data?

– Take the guesswork out for the user, but give them obvious cues

– Get rid of any needless gestures

– First impressions hold the most value for The Flick (scroll down to the bottom, and then quickly back up to the top)

– Don’t have to many hidden menus for when a user applies the The Washing Machine method (someone who swipes up and down/right and left)

– We go to great lengths to avoid typing, so consider that when designing your mobile site

– Use icons in a way that is consistent with other sites

– Essential content should be on the page or on the top (hamburger menus are iffy)

– Sound cues are a missed opportunity – only 74% of people leave their ringer on

Overall, there is much room for improvement for the user experience of mobile devices. They are attached to their phones almost as if it were another limb. Aside from the great content she was able to share, she had an upbeat and entertaining presentation style that did not go unnoticed by the crowd. If I get the chance to attend another talk by Pamela, I won’t miss the opportunity!

by KLI | Sep 10, 2014 | Android, App Development, e-commerce platforms, mobile, usability

by Kathleen Henning and Phil McGuinness

In part two of our series on mobile payments, Phil and Kathleen review a few exciting mobile payment options and talk about the near future of mobile payment technology.

Phil: In part one, Kathleen and I field tested the PayPal and Google Wallet apps, two popular forms of mobile payments. However, there are a few up and coming forms of payment that take a different approach to the process.

Softcard/ISIS

Due to an unfortunate coincidence, the company ISIS is in the process of changing its name to Softcard to avoid sharing its name with a militant terrorist group. However, that’s not the only obstacle facing Softcard. While Google Wallet restricts the use of Near-Field Communication (NFC) payments to Android, Softcard is bringing these payments to the iPhone as well. In order to do that, users need to make a one-time investment in a special phone case (minimum of $50).

Requiring users to invest additional money to make payments creates a difficult barrier to adoption, especially when NFC payments aren’t yet accepted on a widespread basis. Softcard does, however, address one of our gripes about Google Wallet. It allows users to search for local stores that accept NFC payments. The app also boasts numerous security features on their site, including a PIN entry required before each purchase, the ability to freeze your wallet remotely, as well as using unique transaction IDs for each payment.

LoopPay

Instead of relying on NFC, consumers have another option in LoopPay. LoopPay gets around NFC by imitating credit cards in a way that allows the familiar credit card readers to get the signal. This allows LoopPay to work in almost any store, using the technology that’s already in place. As with Softcard, though, this also requires the user to make an initial investment. At this time, Loop Wallet provides the option of a reasonable $39 for a key fob, or $99 for a charging phone case and key fob.

As NFC adoptions treads water, LoopPay is an interesting alternative to watch. At the time of this writing however, Apple is expected to announce NFC as a standard in the iPhone 6, which could change the field dramatically. Kathleen, our resident Apple expert, will break down the rumors and implications this could have later in the article.

Coin

Another interesting option in the mobile payment field is the Coin Payment Card. This works similarly to LoopPay, but instead of requiring a fob or charging case, users can store their cards in a credit card-shaped item and switch between them at the tap of a button. This has the added benefit of removing any questions of NFC adoption or security concerns with wirelessly transmitting credit card information. In addition, it provides the comfort of a payment process with which both users and vendors are familiar. There is no need to fumble with a mobile app or worry about having mobile service if you can simply hand a card to a waiter or cashier.

Another neat feature unique to this system is added security through a Bluetooth tether. Coin uses a low-energy Bluetooth signal to connect with your phone, which will then alert you if you get too far away from the card, say by walking away from a shop and leaving it on the counter. So what’s the downside? Again, users need to invest in the card, and right now it is still in the crowd funding stage. Early investors can buy the card for $50, and once it’s released it will retail at $100. If somehow Coin can manage to bring the price down, I could see this being widely adopted by consumers interested in both familiarity and security.

Now, Kathleen will talk about Starbuck’s success with mobile payments and Apple’s likely upcoming adoption of NFC in the new iPhone.

Starbucks

Starbucks

The best part of the Starbucks app is how little effort it involves. Once you enter in your gift card number and the 8-digit identifying code on the back, you’re good to go. You can add money via the app, set it up to automatically reload when running low, and even add it to iOS’s Passbook. Using it in the store is a seamless process. Unlike some of the other apps we’ve tested, it just works. You don’t have to think about it, and since the store has integrated it on their end paying by app is as natural as paying by credit card. This too works independently of NFC capabilities.

Starbucks in Korea has a new feature called Siren Order. Customers can enter in their order details and receive a QR code, which is scanned by baristas at the counter. Starbucks is thinking about rolling out app preorder capabilities in the US in the next three to six months.

Apple Pay

Apple Pay

As of September 8, 2014, Apple has entered the mobile payments field with Apple Pay. As of January 2014, 42% of smartphone owners in the US own some model of iPhone, many of these older models. Apple Pay will work on the iPhone 6, the iPhone 6 Plus, and the Apple Watch. Users will scan the front of their credit/debit card, enter the CVV, and be able to make payments. Apple will generate a unique code each time a user wants to make a payment. This will work in physical stores, online, and in apps. Merchants like Starbucks, Whole Foods, Duane Reade, Disney, Bloomingdale’s, and Uber are already signed up. American Express, Visa, MasterCard, and most major US banks are currently participating on the credit/debit card side. I look forward to seeing how this transforms the mobile payments process, hopefully for the better!

Personally, I’m optimistic for a trickle down effect to smaller merchants by next summer so it can be available at Smorgasburg and Governor’s Ball. A lot of the payments systems we’ve showcased are promising, but none of them have gained widespread adoption. I’m hoping Apple’s entry into the market will change this outcome.

by KLI | Aug 7, 2014 | Android, e-commerce platforms, mobile, usability

By: Kathleen Henning and Phil McGuinness

After a challenging experience with mobile payments at a New York music festival, our researchers decided to get together and assess two of the leading mobile payment options currently on the market. In Part One of this two-part series, we field test PayPal and Google Wallet apps on both iPhone and Android smartphones. Next month, we’ll review the mobile payment landscape and share some interesting new developments.

Let’s see where Kathleen Henning and Phil McGuinness stand on these mobile giants.

Kathleen: As I was preparing to attend the Governor’s Ball festival this summer, I was super psyched. Not only did they have an amazing lineup, but the food & drink section asked for my credit card information so I could make mobile payments. Since I hate carrying cash (and really anything), this was a dream come true for me. Unfortunately, it was a little too good to be true. I entered all of my information only to find that no one was accepting the GovBall app as payment. Instead, there was the PayPal app…

Most festivals, for better or worse, are known for having notoriously awful cell service. GovBall was no exception. Using the PayPal app required downloading it, logging in, taking a picture of yourself, and saving your account information. All of those steps required far more Internet speed than was available. Day 1 I had no luck. Day 2 I was able to purchase free Brooklyn Soda Works. Day 3 the vendors I tried weren’t accepting it anymore because of technical failure.

This experience got me thinking, does this app work any better with a stronger signal? Was my experience simply based on the context of the festival? I opened up the PayPal app, looked through the local businesses available, and took a trip to Van Leeuwen’s for a (mostly free) scoop of ice cream with ridiculously delicious fudge. The app worked! And then it crashed my iPhone. However I was able to pay and get the $5 coupon discount and, more importantly, enjoy a little piece of ice cream heaven.

Phil: After Kathleen and I discussed her experience, I went ahead and tested the take out ordering for the PayPal app on Android. I found that it works like any food ordering app. All mobile ordering relies squarely on the structure and capabilities of the Eat24Hours service. My experience with setup was fairly easy, although you have to enter a lot of basic information, including a picture, which might deter some people.

After set up, I found that the app was slowing down the ordering process with numerous errors. At first the PayPal app was stuck on the “delivery” setting for food, and even when I toggled the setting to “takeout” the delivery fee and minimum order remained on screen. The app’s ordering function also repeatedly timed out with a plain text screen reporting an unspecified error. On top of all this, the ordering process was generally very slow to load. Feeling discouraged, I shut down the app for the day and ordered through other means.

One error encountered with PayPal: Despite selecting “Pickup” the app still thought I was ordering “Delivery”.

The next day I opened the app again to order some lunch, and thankfully the process went smoothly. I was able to pick up my food without any hiccups. I hope that the errors Kathleen and I experienced will be worked out over time, so the app can become a more reliable source of ordering.

Google Wallet doesn’t provide a method to find local stores where payment is accepted, limiting its effectiveness as a wallet or credit card replacement

I also reviewed Google Wallet on Android, a mobile payment app whose main point of differentiation is the use of Near Field Communication (NFC) for point-of-sale payments. Since I had already used Google Payments in the past, the setup was quick and easy. The trouble started when I tried to find a location to use the payment method. Google’s site doesn’t provide any list of merchants where Google Wallet payments are accepted. This may be due to vendors being slow to adopt NFC, which is necessary for this type of payment to spread. Unfortunately this leaves the user to find locations themselves, making this convenient method of payment not so convenient. I spent a week in Silicon Valley and a week traveling and I didn’t find a single location to make a payment with Google Wallet. With limited adoption and no means for finding out where this type of mobile payment is accepted, Google Wallet is far from replacing my trusted standard leather wallet.

Kathleen: In this day and age, there’s a lot of potential for mobile payment systems to streamline a manual process. I was at a concert recently where the luxury box seats were offered a paper menu to select menu items and have them brought to your seat. This section was organized by Live Nation, the international promoter. A setting like this one would be perfect for mobile payments. If I could log into my Live Nation app, select what I want from the menu, hit submit, and have it delivered to my seat, I would be so happy!

In conclusion: There are definitely still some usability issues in this area, but we here at Key Lime Interactive are super excited about the future of mobile payments, especially at concerts and music festivals! Next month, we’ll review the current mobile payment landscape, including some novel new approaches to address problems like those Kathleen and Phil encountered above. Until next month…