While AI and large language models are making waves across industries, most mobile banking apps still rely on more traditional chatbot experiences. These tools offer users a quick, self-directed way to resolve issues, but their capabilities vary widely across the financial services landscape.

In Key Lime Interactive’s analysis of leading mobile banking apps, a clear framework was uncovered that categorizes chatbot functionality into three distinct levels of sophistication. This structure helps product and UX teams assess where their experience stands—and where it can go.

- Level 1: Basic or Absent

Chatbots at this level offer minimal interaction, if present at all, delivering basic keyword-based responses with limited follow-up capabilities. - Level 2: Functional and Guided

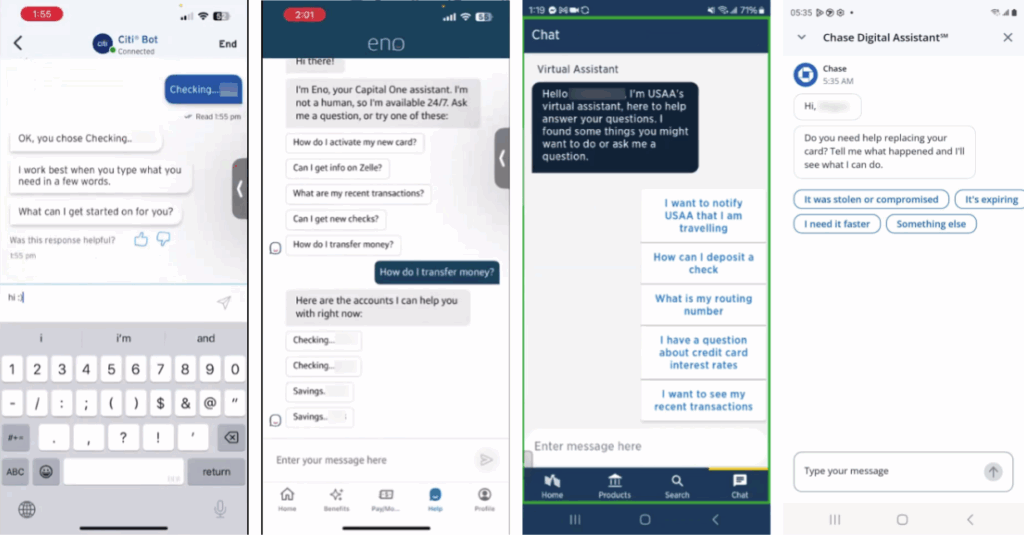

These experiences provide structured conversation flows, offer quick-start suggestions, and link users to relevant in-app actions. They create smoother user journeys, even if the chatbots’ natural language understanding remains limited.

(Functional and Guided Chatbots from left to right: Citi, Capital One, USAA, Chase)

- Level 3: Enhanced and Insightful

At the most advanced level, chatbots begin to offer more contextual value, such as proactive tips, visual insights, and alternative input methods, positioning them as more than just support tools.

While none of the mobile banking apps we reviewed currently leverage large language models, the spectrum of existing chatbot designs offer potential opportunities for financial apps to differentiate themselves from their competitors.

Want to see how your mobile experience compares?

Request access to the full Mobile Banking Competitive Insights Report, including side-by-side evaluations of chatbot capabilities, authenticated feature sets, and user expectations across top institutions.